Record-keeping obligations

As an employer, you have certain obligations concerning the maintenance and retention of employee records.

As outlined in the Penalties Summary module, there are a range of penalties that apply where an employer fails to comply with their record-keeping obligations.

Retaining employment records is not just important for complying with your obligations towards employees; they are also essential for protecting your business. If an underpayment claim were made against your business, it is essential that you have retained appropriate records to demonstrate that the employee was paid correctly.

What form do employment records need to be kept in?

Employment records must be:

- legible;

- in English; and

- written or electronic – if electronic, it must be printable.

What are the employment records that I am required to keep?

Key employment information

- the employer's name (e.g. Business Name Pty Ltd);

- the employee's name;

- the date that the employee commenced work for the employer;

- an employee's employment type (i.e full-time, part-time, casual, etc.);

- whether the employee's employment is permanent, temporary or casual; and

- the employee’s classification under the applicable award or enterprise agreement (if applicable and required by the relevant industrial instrument).

For each day that the employee performs work (best-practice)

- the time the employee started work and the time that the employee finished work;

- the periods of time that the employee was paid for performing work (i.e. times that the employee was not on an unpaid break); and

- details of work breaks including meal breaks.

Award/enterprise agreement specific records

The industrial instrument(s) applicable to your business and employees may include other types of specific records that are required to be kept, for example requirements to retain details of an employee’s address or to retain rosters that applied to the employee. Be sure to review your award or agreement to identify if there are any specific records that you are required to keep.

Leave entitlements

Regardless of whether an employee is covered by an industrial instrument or not, an employer must retain employment records that reflect all leave taken by the employee (regardless of the type of leave or whether the leave was paid or unpaid). These records must also include the balance (if any) of the employee’s leave entitlements.

An employer must also retain records that contain the information necessary for the calculation of long service leave; this includes information such as an employee’s commencement date and the employee’s time and attendance data.

What information do I need to include in payslips?

Employers are required to provide their employees with either payslips (electronic or hard copy) that include the following, among other requirements:

Employer information

- the employer's name; and

- the Australian Business Number of the employer (if any).

Employee information

- the employee's name;

- the employee’s classification under an industrial instrument (if applicable and required); and

- the employee’s employment type (i.e full-time, part-time, casual, etc.).

Payment information

- the period to which the payslip relates;

- the date of payment;

- the gross and net amount of the payment;

- any amount paid to the employee that is a bonus, loading, allowance, penalty rate, incentive-based payment or other separately identifiable entitlement; and

- if an amount is deducted from the gross amount of the payment, the name and any applicable number of the fund or account into which the deduction was paid.

If the employee is paid an hourly rate of pay

- the rate of pay for the employee's ordinary hours;

- the number of hours in that period for which the employee was employed at that rate; and

- the amount of the payment made at that rate.

If the employee is paid an annual rate of pay/annual salary

- if the employee is paid at an annual rate of pay, the rate as at the latest date to which the payment relates.

Superannuation contributions

if the employer is required to make superannuation contributions for the employee:

- the amount of each contribution payable in relation to the period to which the payslip relates; and

- the name and any applicable number of the fund to which the contribution was made or will be made.

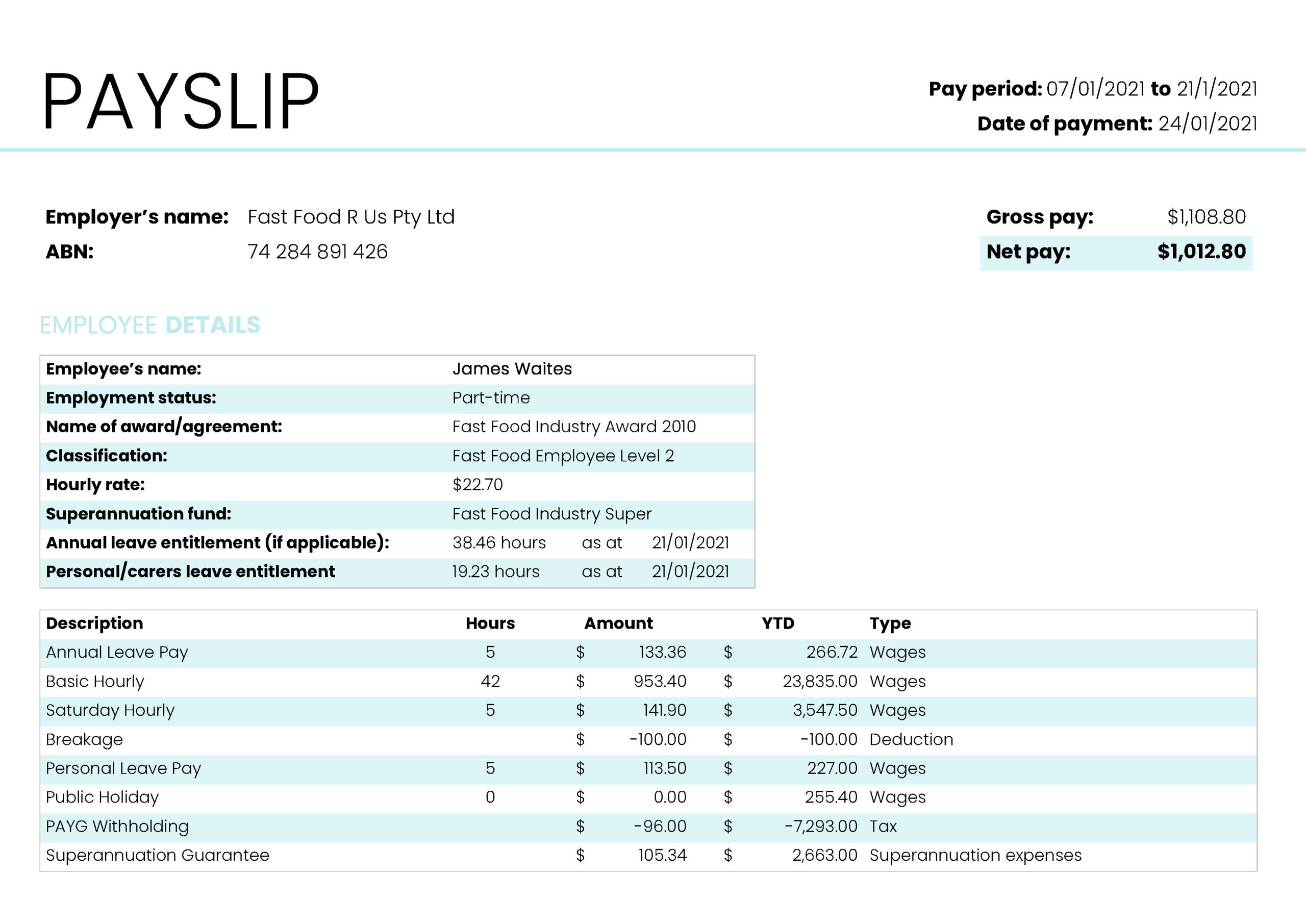

Accurate and detailed payslips are essential to achieve record-keeping compliance. The payslip you are about to see is included for the purposes of example and learning. It is not intended to be used as a template.

Instead, it highlights some information required to be included within payslips as well as providing best-practice tips.

Let's take a closer look at the individual elements.

It is important to include the date range covered by a payslip. This is commonly referred to as a "pay period".

Because you do not need to specify the exact days or times to which each specific payment relates (including any annual leave or public holidays), this date range helps employees to understand

Payment DateEvery payslip you issue must include the date of payment.

Because payslips must also be issued within one day of payment being made, including this date on a payslip helps demonstrate that you have complied with this requirement.

Payment AmountYou need to include both the gross (before tax) and net (after tax) amounts on an employee's payslip.

An employee’s gross pay includes any ‘pay as you go’ (PAYG) withholding required by the ATO.

Employee statusAn employee's status may either be full-time, part-time, or casual.

AwardIncluding details of the modern award or enterprise agreement that covers an employee ensures that both you and the employee are clear on the industrial instrument that applies.

Further information about modern award and enterprise agreement coverage can be found here.

ClassificationAn employee’s classification under a modern award or enterprise agreement is effectively their job. Each classification level also attracts a different minimum rate of pay.

If you are paying an employee in line with your modern award or enterprise agreement, each payslip you issue should reflect the correct minimum rates of pay.

Further information about classifications can be found here.

Hourly rateWhen stated on a payslip, this amount should not include any penalties or loadings.

This is sometimes referred to as the ‘base rate’. If you are paying in line with the minimum rates of pay in a modern award, this amount will increase once per year, usually from 1 July.

DescriptionSome payroll software will be preconfigured for your modern award, and will already include all of the relevant pay codes. However, it is ultimately your responsibility to make sure your employees have been paid correctly.

Annual LeaveMany modern awards and enterprise agreements require employees to be paid a 'loading' while on annual leave.

This is an additional amount that an employee receives simply for being on annual leave.

Basic hourlyThis is the number of hours worked by an employee which attracts the 'base rate' referred to above.

Saturday hourlyWhere an employee becomes entitled to receive an additional payment based on when work is performed (commonly known as a 'penalty'), this should be listed separately on their payslip.

Common examples include evening penalty, Saturday penalty, Sunday penalty.

BreakageThere are very few circumstance where a deduction will be lawful. Most commonly, deductions must be authorised by an employee in writing such as in the cast of union fees. However, some modern awards and enterprise agreements allow other kinds of involuntary deductions in very limited circumstances.

Personal leave payUnder the Fair Work Act 2009 (Cth) the taking of personal or carer’s leave (including sick leave) is only limited by notice and evidence requirements, such as a medical certificate. This means that an employee can take sick leave without your permission, provided that they notify you as soon as reasonably practicable.

TaxAs a deduction from pay, the amount of tax withheld from an employee's pay must be recorded.

Superannuation GuaranteeYou will generally be required to make superannuation guarantee contributions if an employee's 'ordinary time earnings' exceed $450 per month gross (before tax) and the employee is either:

- over 18 years of age; or

- works over 30 hours per week.

What records need to be kept for superannuation contributions?

Employers must maintain a record of superannuation contributions specifying:

- the amount of the contributions made;

- the period over which the contributions were made;

- the date on which each contribution was made;

- the name of any fund to which a contribution was made; and

- the basis on which the employer became liable to make the contribution, including:

- a record of any election made by the employee as to the fund to which contributions are to be made; and

- the date of any relevant election.

Should you have any questions concerning how to calculate superannuation contributions or further records you may be required to keep in respect of superannuation payments you should refer to the Australian Taxation Office’s resources for employers.

How long do employment records need to be kept for?

All employment records need to be retained for at least seven years from the date that the record is made. However, in Western Australia records that relate to an employee’s long service leave must be retained for at least seven years from the end of the employee’s employment with the business.

What penalties apply for failing to meet record-keeping requirements?

Where an employer fails to meet any of the above-mentioned requirements, they may be liable to pay penalties. A penalty is payable for each contravention.

The penalties for such contraventions differ depending upon the type of contravention ranging from relatively minor penalties of a few thousand dollars to penalties of hundreds of thousands of dollars for serious contraventions. Should an allegation be made against your business of contraventions of record-keeping obligations, you should consider obtaining legal advice.

Further details of the penalties that can apply are outlined in the Penalties Summary module.

Inspection and copying

If an employee makes a request to their employer to inspect or copy any of their employee records, the employer must make a copy available for inspection and copying.

The process required will depend on where the records are kept. If the employee record is not kept on the premises, the employer must make a copy available at the premises or post a copy to the employee, as soon as practicable after receiving the request. If the employee record is kept on the premises, the employer must:

- make a copy available at the premises within 3 business days; or

- post a copy of the record to the employee within 14 days of receiving the request.

Further information can also be obtained at www.fairwork.gov.au.