Wage obligations under enterprise agreements

In order to comply with wage obligations towards employees, an employer will need to understand the following:

Identifying the applicable

Identifying the correct rate of pay that applies to each of your employees is an essential part of ensuring wage compliance.

Once you have identified the enterprise agreement that covers your employee’s employment and the employee’s classification under that agreement, the next step is identifying the correct rate of pay for the employee.

Under most enterprise agreements an employee’s minimum rate of pay is outlined in a ‘minimum rates’ clause.

Part-time and casual employees

Under most enterprise agreements, employees who are casual or part-time are required to be paid a pro-rata amount of the minimum adult wage according to the hours of work they have performed.

Ordinary hours of work

Most enterprise agreements will use the expression “ordinary hours”. This refers to the hours of work performed by an employee for which they are to be paid at the ordinary rate for the enterprise agreement/the minimum adult wage.

Usually hours of work performed have to fall within certain time periods or occur on certain days to be defined as “ordinary hours”.

Penalty rates

Many enterprise agreements will include higher rates of pay applicable to work performed on a Saturday or Sunday. Such time is still classed as ordinary hours of work.

Penalty rates also often apply for late night, early start and public holiday work.

Overtime

An enterprise agreement will usually include an overtime clause. Overtime occurs where an employee performs work outside of their ordinary hours of work. It is important as an employer to review such clauses thoroughly to ensure that employees receive an overtime payment whenever it is owed.

The actual rate of pay that is charged for overtime varies from agreement to agreement. Generally, overtime tends to apply at either the rate of time and a half or at double time.

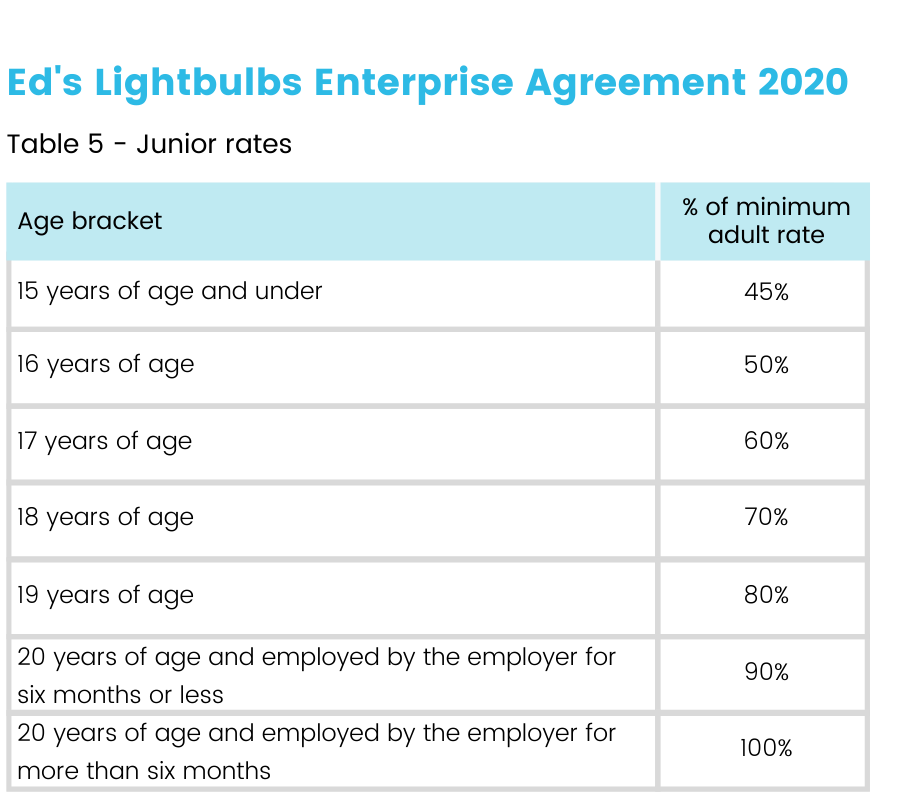

Junior rates

You should also be aware that depending upon the age of your employees they may only be entitled to be paid a percentage of the applicable wages for an adult employee under the enterprise agreement.

What resources are available to ensure that I meet my wage obligations towards employees?

The Fair Work Ombudsman can assist you with questions you have concerning employee pay, applicable pay rates, employee hours of work and leave entitlements.

Enterprise agreements and contracts of

As an employer, it is important to be aware of how the enterprise agreement that covers your business interacts with contracts of employment used for your employees.

It is important to understand that an employee’s entitlements as outlined in an enterprise agreement cannot usually be removed by an employment contract. For example, if an employee is entitled to receive a penalty rate for work performed on a Sunday under the enterprise agreement, they cannot “sign away” this entitlement under a standard contract of employment.

What can an employment contract do?

Properly used, employment contracts play a crucial role in ensuring wage and record-keeping compliance. The use of employment contracts achieves the following:

Explains when and how an employee is to be paid

An employment contract should confirm how frequently an employee is to be paid (i.e. weekly, fortnightly, monthly) subject to the enterprise agreement. It should also explain if an employee is to be paid:

- at an hourly rate in line with the enterprise agreement;

- at a higher hourly rate than the enterprise agreement; or

- a salary that compensates the employee for their enterprise agreement entitlements.

Ensures compliance with record-keeping obligations

Many enterprise agreements include requirements that an employee is informed in writing as to the enterprise agreement they are covered by, their classification under that enterprise agreement, their type of employment and when their hours of work will be performed. The inclusion of such information in an employment contract ensures that this information is recorded and retained in one place.

If you have employees covered by a modern award, click here for more information.